Welcome to Evolve Open Banking

The Foundation for Your Financial Imagination

You know your Users. We know banking. Let’s build together.

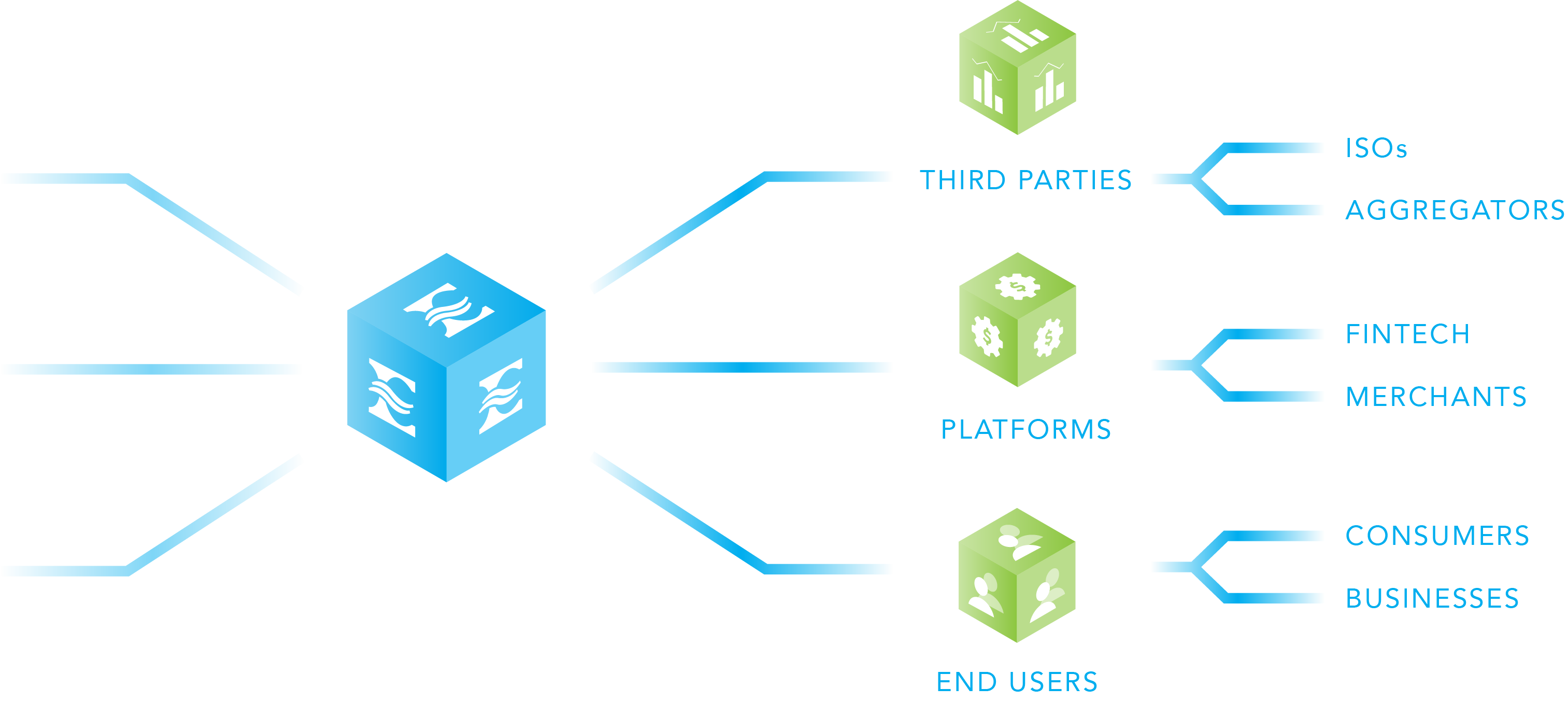

Evolve's Ecosystem

Our BaaS Environment

No smoke and mirrors here. Connect to Evolve’s fully integrated tech-stack to launch your financial products.

In the Press

NACHA.ORG

Evolve Climbs to 32 on Nacha Top 50 ACH Originators List

GGV Capital US

Evolve Partners Named to the Fintech Innovation 50

AMERICAN FINTECH COUNCIL

Evolve Partners with American Fintech Council

FORBES

Mercury Partners with Evolve to Offer $3 Million in FDIC Sweep Program

NACHA.ORG

Evolve Climbs to 38 on Nacha Top 50 ACH Originators List

NACHA.ORG

Evolve's Hank Word Elected as Nacha Board Member

Arkansas Business

Tech Work Fuels Huge Growth at Evolve Bank & Trust of West Memphis

PYMNTS.COM

Evolve Sponsored, Bond Debuts Custom Credit Builder Card

AMERICAN BANKER